Why Hiring a Financial Adviser is Beneficial

I recently met with a couple who are now clients, and they described their previous experience of advice in this way:

“We would be taken out to lunch once a year, told about funds and where we should be invested and that we should put more into our pension. But that was it. And I began to question the benefits of the relationship and what we were paying for.”

We’ve heard this same story many times. Clients know that hiring a financial adviser is essential, but they’ve never really been told why! The reasons have rarely been clearly stated or outlined.

Because of this, many clients may feel left in the dark and unsure of what exactly they’re paying a financial adviser to do. This leaves clients frustrated and even more worried about their finances.

That’s why we feel it’s crucial that potential clients receive a clear outline of what financial advisers do and why it is beneficial for their finances and future well-being. We’ve rounded the most important reasons below to make things simpler.

Receive Expert Advice and a Tailored Financial Plan

A financial adviser is a full-time professional who can provide a wealth of expertise and knowledge regarding financial planning, tax allowances, and other related topics.

One main benefit of working with a financial adviser is their ability to create a financial plan, backed by cash flow modelling, to help you meet your goals. Advisers have access to a wide range of investment options, so they can help you find investments that fit your specific needs and risk profile, providing you with a clear pathway to achieve your financial goals.

By having expert guidance at your side, you will be more likely to make sound investments and avoid common financial pitfalls.

Save Time

For many people, managing their finances is a time-consuming task. Working with a financial adviser, who can take on the bulk of the work for their clients, can free up valuable time for you to focus on other areas of your life.

For example, a professional financial adviser can save time by managing investment portfolios or creating a financial plan to help maximise use of your tax allowances.

Discover Peace of Mind

Some people feel overwhelmed by the idea of managing their finances. This can lead to stress and anxiety.

A vital benefit of a financial adviser is the peace of mind it brings.

Once you’ve found the right financial adviser you will be able to relax, knowing that your finances are taken care of by an expert. Advisers can also help you:

- Better handle your relationship with money, both now and in the future

- Manage your money in the event of a financial crisis or other difficult situation

- Navigate complicated financial matters, such as investments and insurance policies

- Plan for retirement to ensure that your assets will last throughout your lifetime

A financial adviser can help you develop a plan and track your progress, which can help you feel more in control. This peace of mind may be the key to unlocking long-term wealth growth.

Become More Objective and Achieve Your Long-Term Goals

One of the greatest threats to your financial plan is making rash decisions based on emotions.

Why? When it comes to money, many people feel a strong emotional connection. After all, this can be a good thing – it’s human nature to want to protect what we have and make the most of it. However, when it comes to our finances, being objective can be key to achieving our financial goals. That’s where a financial adviser comes in.

A financial adviser is there to help keep you from making this mistake. Being more objective means they will be extremely helpful in making informed decisions about your finances and achieving your long-term goals.

How to Find the Right Financial Adviser

When looking for a financial adviser, it is essential to do your research. Beyond a simple Google search or through word of mouth, there are several resources available to help find the right adviser for you, including:

- Industry publications

- Financial websites

- Individual advisers' profiles

Be sure to interview several advisers before making a decision. Ask about their experience working with clients of different ages and investment profiles. It is also important to ask about their fees and how they will charge you.

During your interviews, there are two primary markers you need to look out for:

Accessibility & Openness

Firstly, finding an adviser is difficult, and even when one is found, they are often already working with a larger number of clients, so implement minimum criteria for income and level of wealth required.

When interviewing, keep an eye out for advisers who seem genuinely accessible in terms of client criteria, such as being open to individuals with a wide range of incomes and wealth levels. Even if your income is on the higher end, having an accessible adviser will reassure you that they are most interested in helping individuals, whilst they’ll loyally stick by you even if your circumstances change.

A financial adviser should also be very accessible for you to arrange regular meetings with. For example, our day-to-day work is mainly done remotely using sophisticated technology that has been in place since before the pandemic. This means we can virtually meet customers wherever they are in the UK, saving time (and our clients money!) on transport.

Level of Client Engagement

Secondly, advisers are often too focused on investment management and fund performance. This leaves the client's experience dull, routine, and unengaging as the adviser tries to brush past anything personal and move straight to talking about money.

Clients are left feeling unheard, and their experience is limited to filing policy forms and awaiting an annual appraisal in the post. As a result, both advisers and clients are not fully engaged in personalised financial decisions and plans.

During the interview, try to feel how you and the adviser get along personally. Remember, this is someone you have to trust, and sustain a relationship with, far into the future.

The ideal financial adviser will maintain a high level of engagement with all of their clients, no matter if they have been with them for decades or only a few days. They should have a client-centred approach that focuses on:

- Creating a solid financial plan

- Making sure the plan is continuously tailored to your personal circumstances

- Helping you achieve your long-term goals in a way that suits you

Next Steps

We do things a bit differently.

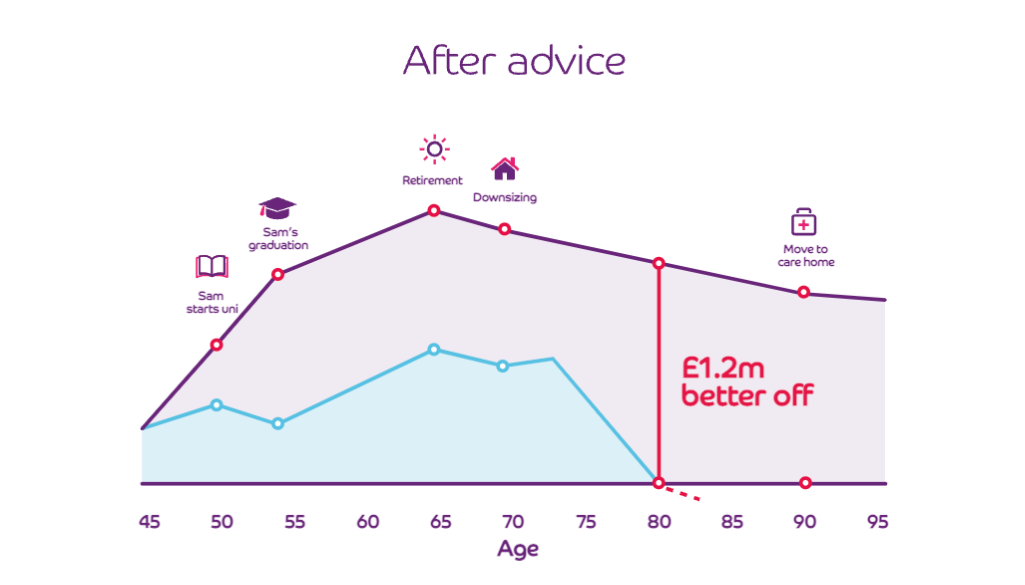

As we know how vital it is for our clients to see and understand the impact of their decisions on their longer-term financial position, we created our state-of-the-art Lifeline technology to help visualise your financial plans. By bringing clients' circumstances to life right before their eyes, you can easily keep track of your assets, investments, and goals. Plus, it sparks interesting “What if” discussions about what your future could look like.

From Pensions & Retirement, Investments, Savings & ISAs, Business Finance, Tax Planning, and Mortgages, a financial adviser can help you navigate the complicated world of finances with ease. Why not get started today?

Disclaimer:

This blog post is a marketing communication for information purposes only and is not intended as an offer or solicitation to buy or sell any particular financial product. Personal opinions may change and in producing this article we have not taken into consideration any individual circumstances, therefore it should not be seen as advice or a personal recommendation.

Any references to past performance should not be taken as a reliable indication of future returns. The value of an investment, and any income from it, can fall or rise. Fees and commissions may have not been expressly indicated, and you should take into account the effects that these have on the performance of a financial portfolio.

Octopus Wealth is authorised and regulated by the Financial Conduct Authority.